“Opportunity Funds” is quickly becoming a discussion topic in Sarasota. Locals and investors are talking more frequently about Opportunity Funds, Opportunity Zones, and the tax incentives they provide, but very few people are familiar with how they pertain to Sarasota.

According to Fundrise.Com, “Opportunity Funds promote investment in the development of low-income communities across the US, by offering investors federal tax advantages that are only available through the new Opportunity Zone program.”

In the simplest of terms, the government is providing tax breaks and incentives to investors in exchange for providing much-needed capital to low-income areas. The Opportunity Fund is the investment vehicle required to receive the tax benefits.

When an investor realizes capital gains from selling an appreciated asset, they must typically pay taxes on that amount. However, if they choose to reinvest their capital gains into an Opportunity Fund, their tax burden is substantially minimized.

The Opportunity Fund then reinvests at least 90% of its holdings into partnership interests, businesses, and/or properties within a qualified Opportunity Zone. The properties may include real estate, factory equipment, businesses, etc. and provides an opportunity for the investor to improve the community in which they reside.

The longer the investor reinvests their capital gains in the Opportunity Fund, the more benefits they receive. Several tax advantages include:

- Capital gains placed in a certified Opportunity Fund will not be taxed through the end of 2026 or when the investment is sold, whichever comes first.

- Any gains are permanently shielded from taxes if the investment has been held in the Opportunity Fund for 10 years.

- In addition, for tax purposes, after seven years, the initial investment will be discounted by up to 15 percent.

According to CNBC (link: Https://Www.Cnbc.Com/2018/10/19/Investors-Can-Get-Tax-Breaks-For-Investing-In-Opportunity-Zones-Treasury.Html), the tax advantages are summarized below:

- The proposed regulations clarify that only capital gains are eligible for preferred tax treatment.

- Investors who can participate include individuals, corporations, businesses, REITs, and estates and trusts.

- Treasury said additional guidance will be released before the end of 2018, with final rules likely to come in the spring.

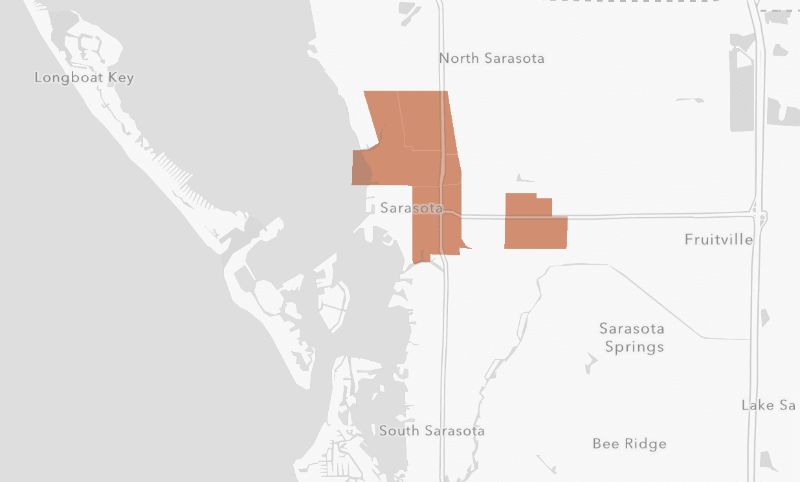

Opportunity Zones in Sarasota

At this point, you’re probably wondering if there are Opportunity Zones in Sarasota, and we’re pleased to say, “Yes.”

If you’re wondering just how much money you can save by investing in Opportunity Funds, click on the following link and scroll to the bottom where you’ll find an Opportunity Fund Calculator. (Https://Fundrise.Com/Education/Blog-Posts/Tax-Incentives-Of-Investing-In-Opportunity-Zones)