Ever get tired of hearing people go on and on about “Location, location, location!”, whenever real estate comes up in any given conversation? Yet most real estate investors never look much further beyond their own backyard, when deciding where to invest. Millions of Americans invest in rental real estate, and they all have the same goal in common: to make money. Location is the only factor that you cannot change once you buy a rental property. While you can do repairs to improve the quality and look of your rental property, there is nothing you can do about the location of your investment. “Your real estate property is where it is, and you can’t take it and move it somewhere else.” All the kitchen and bathroom hacks in the world won’t matter if you buy in a neighborhood with low demand. That’s why it’s better to buy a bad property in a good location than to buy a good property in a bad location.

The place where your income property is located will determine your return on investment as it will affect:

- The rental demand and the types of tenants you can attract

- The best property types for rentals

- The property price

- The rental rate – i.e., how much rental income you can make per month or per year from your investment property

- The rental expenses including property tax, insurance, property management, etc.

- Your cash flow: the difference between the rental income and the rental expenses, or how much money you will be able to make as a real estate investor

- Your return on investment, whether you go for cap rate, cash on cash return, or any other measure of profitability in the real estate investing business

- Your rights and obligations as a landlord: local legislation regulating landlord-tenant relations can vary from one place to another

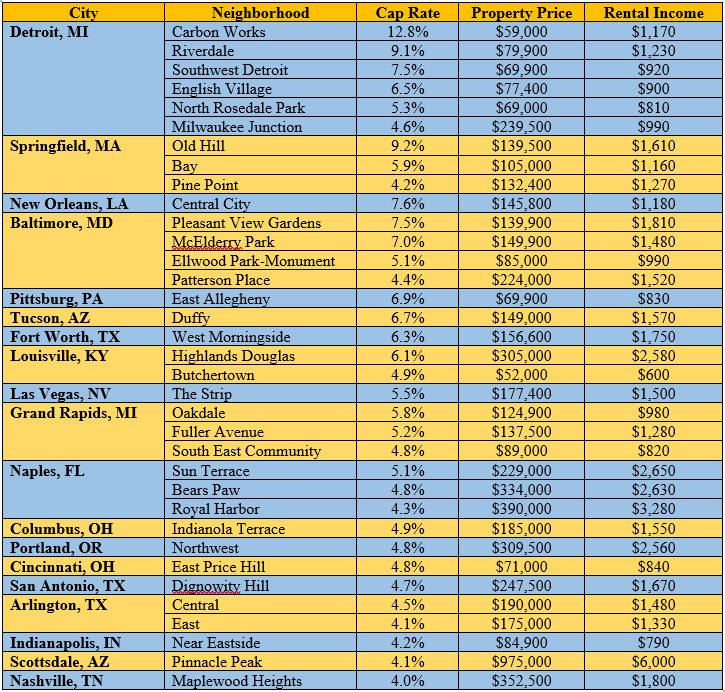

US Neighborhoods with the Highest Cap Rate for Traditional Rental Properties

Data Source: Mashvisor, April 2018

The table above summarizes the best locations for investing in real estate in 2018 for return on investment based on data from Mashvisor. If you were to look at the city-level average cap rate, many of these locations would not reach a cap rate of even 2-3%. Thus, it is important to take a look at the specific neighborhoods as one area in a city can perform very differently from another. Before we have another look at the top places for investing in real estate, let’s have a brief word about the capitalization rate. The cap rate is a measure of return on investment in real estate, which is calculated by dividing the net operating income (NOI) of the property by the property asset value.

Cap Rate Formula

The cap rate has one major disadvantage as a profitability metric over the cash on cash return – that it doesn’t take into consideration the financing method. However, this disadvantage can also work as an advantage as it allows future investors to compare the return on investment across various locations regardless of how they plan to pay for their property. When it comes to good cap rate for investment properties, most real estate experts agree that you should aim for properties with 8% or more of cap rate. Maybe this was true a few years ago. However, the real estate investing world has become so competitive that investors should be happy to score anything above 4-5% as big data shows. Also, when you look at the cap rates for the top real estate investment cities in the US in 2018, keep in mind that these are neighborhood level averages, while specific properties within these neighborhoods could perform significantly better.

Going back to the places where you should be investing your money in real estate properties this year, you can see the variety of options. Variety is indeed one of the beauties of real estate investing. There is no geographical focus of the top real estate markets for investors, so no matter what your personal preferences are, you are bound to find something which matches your taste and investor needs. Whether you prefer to cater to the needs of warm-weather-loving tenants in Naples, FL or those who don’t mind the colder climate of Detroit, MI, our list of the best places to buy an investment property in 2018 has you covered.